In today’s world knowledge is power, and how to harness and give respect to the knowledge you are about ready to acquire will require a tempered attitude and dedication toward reaching the goal that may not be covered in this publication. However, understanding the basics provided in this publication should provide a path for thought, approach, and action taken based on the law, regulations and procedure.

In today’s world knowledge is power, and how to harness and give respect to the knowledge you are about ready to acquire will require a tempered attitude and dedication toward reaching the goal that may not be covered in this publication. However, understanding the basics provided in this publication should provide a path for thought, approach, and action taken based on the law, regulations and procedure.

I would like to extend my appreciation to all of those individuals whom encouraged me to write and have published the second edition of this publication, which certainly will not be the last.

I would like to extend my appreciation to all of those individuals whom encouraged me to write and have published the second edition of this publication, which certainly will not be the last.

Further, since the government itself has become interested in this publication and already has a copy of this publication for at least a year, and have twisted its objective. It a requirement that you the reader should verify the legal citations presented in this publication for your own education and protection; the author and publisher disclaim any responsibility for any liability of loss incurred as a consequence of the use or misuse and application or misapplication, either directly or indirectly, of any advice or information presented…

What is include in the chapter – Table of Contents Introduction Other Source Materials CAVEAT These are some paragraphs from…

Table of Contents Purpose Introduction Uses of The Federal Freedom of Information Act Exemptions From Disclosure (F.O.I.A.) Exemptions From Disclosure…

Table of Contents Background Information The Complaint Filing Your Complaint Service of Summons and Complaint Service By Certified Mail Brief…

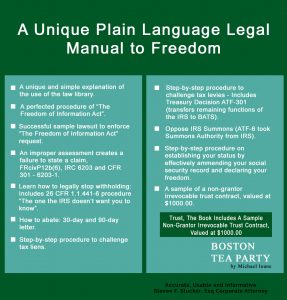

Assessing Your Tax Assessment By Seth Maynard The government can claim taxes from you after the pertinent agency figures out…

Put a Hold on Your Withholding Tax Collections By Seth Maynard Did you know that you can relieve yourself from…

Getting a Tax Abatement By Seth Maynard Tax abatement is a reduction or exemption from taxes. Did you know that…

Releasing a Federal Tax Lien By Seth Maynard Have you ever received a Notice of Federal Tax Lien? Did you…

Releasing a Federal Tax Levy By Seth Maynard Your property may be legally seized, or taken, to pay for a…

Avoiding Self-Incrimination during IRS Summons By Seth Maynard You may be summoned by the Internal Revenue Service (I.R.S.) under the…

Quashing a Third-Party I.R.S. Summons By Seth Maynard It is possible for the Internal Revenue Service (I.R.S.) to summon you…

Nobody Truly is a Citizen or National of the United States By Seth Maynard An important determinant of how much…

Why Should You Use an Irrevocable Trust? By Seth Maynard A trust is a relationship in which assets or properties…